A home makeover can give your space a fresh look without costing a fortune. Many homeowners in Georgia want to upgrade their homes while sticking to a budget. Whether it’s updating interiors, improving curb appeal, or making energy-efficient upgrades, planning can make the process smoother.

The cost of home renovations varies based on project size, materials, and labor. Some upgrades, like new flooring or fresh paint, are affordable and make a big difference. Others, such as kitchen remodels or bathroom upgrades, require more investment but add long-term value. Smart financial decisions help homeowners avoid overspending while getting the most out of their renovations.

Financing plays a big role in home improvement. Some homeowners use savings, while others explore financing options to cover expenses. Loan options can provide flexibility, allowing homeowners to complete projects without delaying plans.

Planning Your Home Makeover Budget

A clear budget helps homeowners avoid unexpected expenses. Before starting a project, it’s important to list out renovation priorities. Breaking down costs into materials, labor, and unexpected repairs can prevent financial surprises.

Comparing different financing options is another key step. Some people choose personal loans, while others tap into home equity for larger projects. Since home values in Georgia have increased, home equity loans have become a popular choice for funding renovations. They often offer lower interest rates compared to credit cards or personal loans, making them an appealing option for long-term investments.

Homeowners looking at this financing option often check home equity loan rates in Georgia before making a decision. These rates vary based on factors like credit score, loan amount, and lender terms. Understanding these details helps homeowners decide if borrowing against home equity is the right choice.

In addition to loans, setting aside an emergency fund for unexpected costs can help. Renovation projects sometimes reveal hidden issues like plumbing or structural problems, which can add to expenses. A financial cushion helps homeowners stay on track without cutting corners on essential improvements.

Prioritizing High-Impact Upgrades

Focusing on high-impact renovations is a smart way to improve a home without overspending. Not every upgrade needs to be expensive to make a difference. Some projects boost home value and aesthetics without requiring major construction.

- Kitchen and Bathroom Updates – Replacing old fixtures, refinishing cabinets, and adding new hardware can refresh these spaces without a full remodel.

- Flooring Improvements – Switching from carpet to hardwood or vinyl can change the look of a room while being cost-effective.

- Lighting Enhancements – Installing modern light fixtures or LED bulbs makes spaces feel brighter and more inviting.

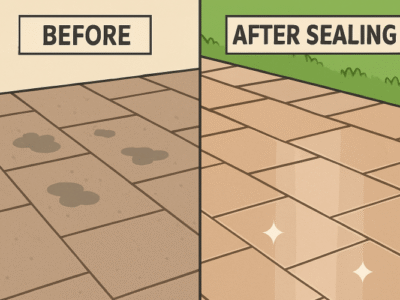

- Exterior Touch-Ups – A fresh coat of paint, new landscaping, or updated siding can improve curb appeal.

Focusing on these upgrades allows homeowners to get noticeable results without spending too much. Choosing timeless styles over trends also prevents the need for frequent updates, helping homeowners save money in the long run.

DIY vs. Hiring Professionals

Deciding between doing the work yourself or hiring professionals can significantly impact renovation costs. Some tasks are simple enough for homeowners to handle, while others require expert knowledge to avoid costly mistakes.

DIY projects can save money, especially for small improvements like painting walls, installing shelves, or refinishing furniture. Many homeowners take on flooring projects, minor plumbing repairs, or simple landscaping to reduce labor costs. Online tutorials and home improvement stores provide guidance, making DIY a practical choice for those willing to invest time in learning new skills.

However, some projects require a licensed professional. Electrical work, major plumbing updates, and structural changes should always be done by an expert. Incorrect installations can lead to expensive repairs and even safety hazards. Hiring a contractor for these jobs prevents long-term issues and often speeds up the renovation process.

To make the best choice, homeowners should compare costs and time investment. While DIY projects can be cost-effective, hiring a professional may be worth the expense when precision and safety are priorities.

Choosing Budget-Friendly Materials

The right materials can make a big difference in cost without sacrificing quality. Homeowners who research options can find affordable alternatives that still deliver great results.

- Flooring: Hardwood floors are popular, but laminate and vinyl plank options provide a similar look at a lower price. These materials are also easier to maintain.

- Countertops: Granite is a high-end choice, but butcher block, quartz, and laminate offer attractive, durable options for less.

- Cabinetry: Instead of replacing kitchen cabinets, homeowners can refinish or paint existing ones for a refreshed look. Changing out hardware can also make a big impact.

- Lighting: LED fixtures save on electricity bills and provide stylish lighting without a high price tag.

- Appliances: Shopping during seasonal sales or looking at refurbished models can cut costs without sacrificing function.

Sourcing materials from discount stores, clearance sections, and secondhand suppliers is another way to stay within budget. Some homeowners also repurpose materials from previous renovations or salvage centers to keep expenses low.

Smart Financing and Cost Management

Even with a budget in place, costs can add up quickly during a home makeover. Keeping track of spending and making adjustments along the way helps prevent financial strain.

One effective way to control expenses is by prioritizing projects based on need rather than preference. Essential repairs, such as fixing a leaky roof or updating outdated wiring, should come before cosmetic changes. This approach keeps the home safe and prevents larger problems down the road.

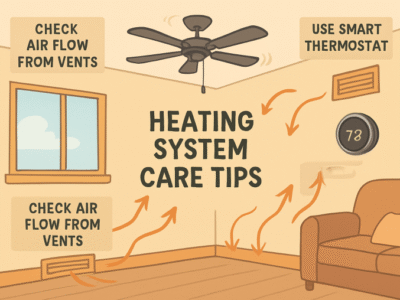

For financing, some homeowners use a mix of savings and credit. Others explore financing options such as home improvement loans or government programs that offer incentives for energy-efficient upgrades. Taking advantage of rebates and tax credits can help offset costs for items like solar panels, insulation, and high-efficiency appliances.

Tracking expenses throughout the project is also important. Using budgeting apps or spreadsheets can provide a clear picture of spending, allowing homeowners to make adjustments if needed. Setting aside a portion of the budget for unexpected expenses prevents last-minute financial stress.

A full home makeover doesn’t have to be expensive when homeowners take a strategic approach. Careful budgeting, choosing the right materials, and deciding when to DIY or hire a professional all contribute to a cost-effective renovation. Managing expenses wisely allows homeowners to upgrade their living spaces without overspending. Making smart choices at every step helps achieve a beautiful home while keeping finances in check.

If you want morе еxciting contеnt visit. Globallyviz.com

Comments