Home upgrades can feel overwhelming, especially when costs start adding up. Many homeowners put off necessary improvements simply because they don’t know how to budget for them.

Ignoring these upgrades can lead to bigger issues down the road. A damaged roof, outdated plumbing, or faulty wiring isn’t just inconvenient it can also lower your home’s value and even put your safety at risk. However, planning your budget wisely can help you avoid these problems without financial stress.

This guide will break down practical steps to help you prioritize, budget, and finance your home improvements.

Prioritize Home Improvements Based on Urgency

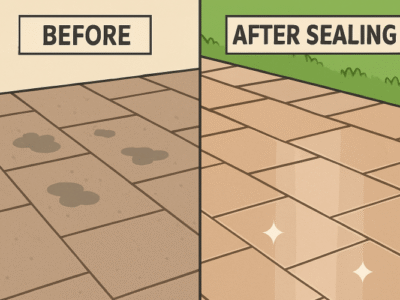

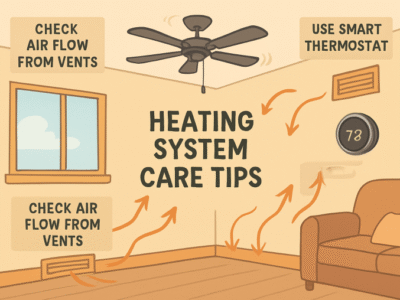

Not all home upgrades are equally important. Some are purely cosmetic, like repainting walls or installing new countertops. Others, like roof repairs, electrical updates, or HVAC replacements, are necessary for safety and efficiency.

Start by assessing your home’s condition and listing everything that needs improvement. Identify which repairs can wait and which ones should be addressed immediately. If your roof has missing shingles or your plumbing is leaking, those issues should take priority over upgrading kitchen cabinets.

If you’re unsure what needs urgent attention, hire a home inspector. They can identify hidden problems that could turn into expensive repairs later. Knowing what to fix first will help you plan your budget wisely and avoid spending on things that can wait.

Get Cost Estimates Before Setting a Budget

A lot of homeowners make the mistake of guessing costs before starting a project. This often leads to underbudgeting and unexpected expenses that derail the entire upgrade.

To get a realistic idea of how much your project will cost, start by researching price ranges for materials and labor. Some upgrades, like painting a room or replacing light fixtures, are relatively low-cost. Others, such as the cost of roof replacement, can run into the thousands, depending on the size of the home and the materials used. If your roof has extensive damage or needs a full replacement, this can quickly become one of the biggest expenses in a home improvement budget.

Contacting multiple contractors is essential. Get at least three quotes to compare pricing, timelines, and service quality. Ask for detailed breakdowns of material costs, labor charges, and any additional fees. The more accurate your estimate, the easier it will be to budget without surprises.

Create a Practical Budget With a Safety Net

Once you have cost estimates, it’s time to set a realistic budget. Many homeowners make the mistake of planning down to the last dollar, which doesn’t leave room for unexpected expenses.

Experts recommend setting aside 10-20% extra in your budget for emergencies. Even well-planned projects can run into problems like hidden structural damage or material price increases.

If the total cost feels overwhelming, look at your finances and decide how much you can afford upfront. You don’t need to pay for everything at once many upgrades can be done in phases to spread out costs over time.

Look Into Financing Options That Work for You

If you don’t have enough savings for a big home upgrade, there are multiple financing options to consider. Some people take out personal loans, while others use home equity loans or lines of credit.

If your upgrade improves energy efficiency like solar panels or better insulation you might qualify for government rebates or low-interest financing programs. Some contractors even offer payment plans that allow you to pay in installments instead of all at once.

Before choosing a financing option, compare interest rates, repayment terms, and fees. Taking on unnecessary debt can lead to more financial stress, so always choose an option that fits your budget comfortably.

Break Up Big Projects Into Smaller Phases

Trying to complete an entire home upgrade at once can be financially overwhelming. Instead of taking on multiple renovations at the same time, consider a phased approach.

For example, if you’re remodeling a kitchen, start by updating appliances first, then move on to cabinets and flooring later. If your roof needs work but isn’t an emergency, replace the most damaged sections first before doing a full replacement.

This approach allows you to spread out costs and make progress without putting too much strain on your finances. It also gives you more time to research materials, find good deals, and avoid rushed decisions that could lead to overspending.

Choose the Right Contractor for the Job

Hiring the right contractor is just as important as choosing the right materials. A bad contractor can lead to delays, extra costs, and poor workmanship, which can completely throw off your budget.

Start by getting recommendations from friends, family, or trusted online reviews. Always check that the contractor is licensed and insured to avoid any legal or financial issues if something goes wrong.

When comparing bids, don’t just go for the cheapest option. A lower quote might mean cutting corners or hidden fees later. Ask for a detailed contract that includes pricing, timeline, materials, and warranty details. This prevents surprises and gives you legal protection if something doesn’t go as planned.

A good contractor should also communicate well. If they take too long to respond or avoid giving straight answers, that’s a red flag. Choose someone who listens to your concerns and explains things clearly so you know exactly what to expect.

Check for Tax Credits and Rebates That Can Save You Money

Many homeowners don’t realize that some upgrades can save them money through tax credits and rebates. If you’re making improvements that boost energy efficiency, you might qualify for government incentives that lower your costs.

For example, installing solar panels, energy-efficient windows, or upgraded insulation can qualify you for tax deductions. Some states also offer rebates for water-efficient appliances or eco-friendly home improvements.

Before starting a project, research available programs in your area. Some utility companies even offer discounts on energy-efficient upgrades, helping you save even more. These incentives can make a big difference in your final budget, so don’t overlook them.

Budgeting for major home upgrades doesn’t have to be stressful. With proper planning, research, and smart financial decisions, you can upgrade your home without breaking the bank.

Start by prioritizing essential repairs, getting accurate cost estimates, and setting a realistic budget with a safety net. Look into financing options, explore cost-saving alternatives, and always hire reliable contractors to avoid unnecessary expenses.

By keeping track of your spending, preparing for unexpected costs, and taking advantage of rebates and tax credits, you’ll be able to complete your home upgrades without financial strain. Planning is the key to making improvements while staying within budget and maintaining peace of mind.

If you want morе еxciting contеnt visit. Globallyviz.com

Comments