Experiencing a disaster that impacts your home can be overwhelming, leaving you uncertain about the extent of the damage and what steps to take next. Determining whether your home is a total loss involves assessing its structural integrity, safety, and financial viability for repairs. This total loss home insurance claims explained here requires careful consideration of various factors, including the level of damage, insurance coverage, and local building codes. We will explore how to make this determination, guiding you through essential steps to evaluate your property and make informed decisions about its future.

Evaluating Structural Damage to Your Home

Determining if your house is a total loss starts with evaluating the structural damage the event produced. Structural damage includes weakened foundations, crumbled walls, roof collapses, or extreme water damage rendering the house unstable or dangerous. Start by carefully looking over the front and inside of your house. Look for obvious foundation cracks, sagging ceilings, damaged load-bearing walls, or other evidence of vulnerable structural elements. Should the damage be significant and involve important supporting systems, it could mean the house is beyond repair.

Additionally important is taking hidden damage into account that might not be obvious right away. For example, even if they seem to be whole, fire or flood damage can weaken structural elements like beams and joists. Hiring a professional structural engineer or building inspector to do a thorough evaluation can help one to have complete knowledge of the damage. They will find any safety risks and decide whether the house has to be destroyed and rebuilt or whether repairs are practical. Repairing major structural problems usually exceeds the value of the property, hence a total loss determination is more likely.

Assessing Safety and Habitability Concerns

When deciding if a house is a total loss, safety and habitability take the front stage. Even if some of the construction is still intact, a house with major health or safety hazards could not be livable for occupation. Hazardous surroundings can result from elements such as structural instability, fire toxic residue, or mold development. For instance, long-term mold infestations brought on by major water damage from floods can seriously affect indoor air quality and endanger tenant health. In buildings, similarly, fire chemical pollution can render materials dangerous.

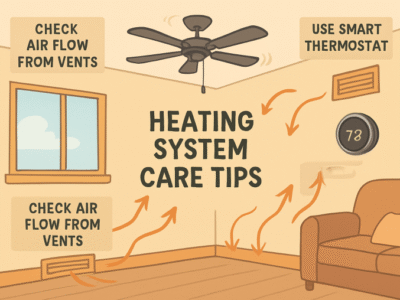

Access to basic utilities is yet another component of livability. The house can be uninhabitable if the disaster has compromised plumbing, electrical systems, or HVAC equipment to the extent that restoration of operation is too costly. Local zoning laws and building codes also matter. Rebuilding or repairing following a disaster could need adherence to revised codes, greatly raising expenses. Should the house not be rebuilt to satisfy these criteria without significant reconstruction, it could be deemed a total loss. Considering these safety and habitability aspects guarantees that choices are taken with long-term well-being in mind.

Calculating Repair Costs vs. Replacement Value

Whether your house is a total loss depends on knowing the financial ramifications of repair expenses against replacement value. To assess the scope of the necessary repairs, first, get thorough quotations from restoration firms or contractors. Add expenses for labor, supplies, and specialized services required to handle problems including damage from a fire or flood. Check these projections against the market worth of your house before the disaster.

When the cost of repairs surpasses a specified percentage usually between 70 and 80% of the pre-disaster value, insurance plans may refer to “total loss.” Reviewing your coverage terms is crucial since insurance and insurers affect this level. One could be more sensible to view the house as a total loss if reconstruction expenses exceed its market value. Account also for possible hidden charges including higher premiums following a claim or temporary accommodation costs during repairs. Financially, it could make more sense to accept an insurance claim and begin anew with a different house.

Considering Emotional and Practical Factors

Although the financial and physical factors are important, emotional and pragmatic also greatly influence whether your house is a total loss. For many, a house holds sentimental value and memories impossible to measure. Your decision-making process may be affected, though, by the emotional toll of surviving a calamity and managing significant repairs. Rebuilding or fixing seems daunting or unworkable; this could be a clue to go forward and start over somewhere.

Your choice should also be affected by pragmatic elements such as location, community relations, and potential hazards. Rebuilding might not be the best option if your house is in a high-risk area prone to recurrent calamities. Crucially, you need to evaluate the property’s long-term viability as well as your capacity to reconstruct your life there. Juggling emotional attachment with pragmatic concerns guarantees that your choice fits your present demands and upcoming objectives.

After a calamity, deciding whether your house is a total loss calls for careful assessment of structural damage, safety issues, financial consequences, and emotional elements. By closely evaluating these factors, you may decide on the course of the future for your property. Although the choice can be challenging, giving safety, financial stability, and long-term well-being top priority will enable you to boldly go ahead.

If you want morе еxciting contеnt visit. Globallyviz.com

Comments